No Country for Old Funds

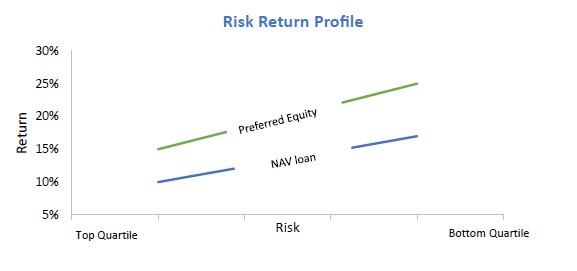

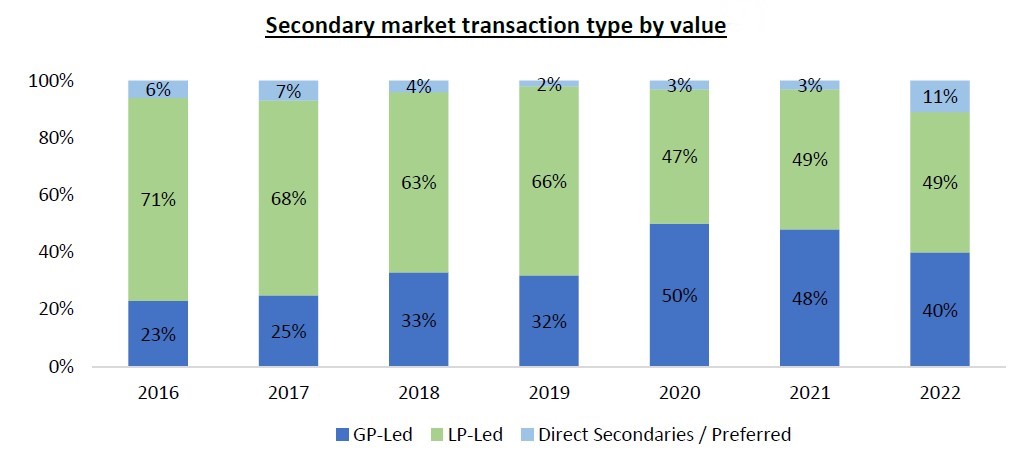

The secondary market has grown by 83% over the last five years and today represent about 5% of private equity (“PE”) assets. This growth includes the sale of LP portfolios, GP-led transactions and a wide range of structured solutions (such as NAV loans). This growth has been driven by limited partners’ need for liquidity as distributions have slowed to a historic low.

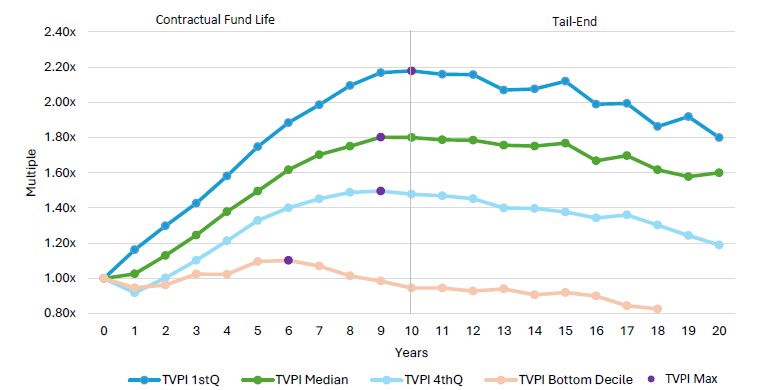

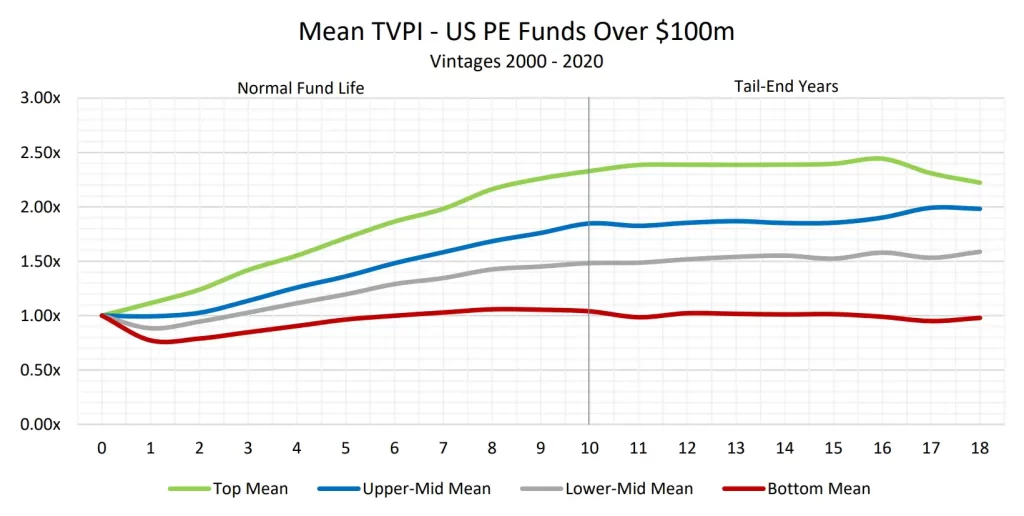

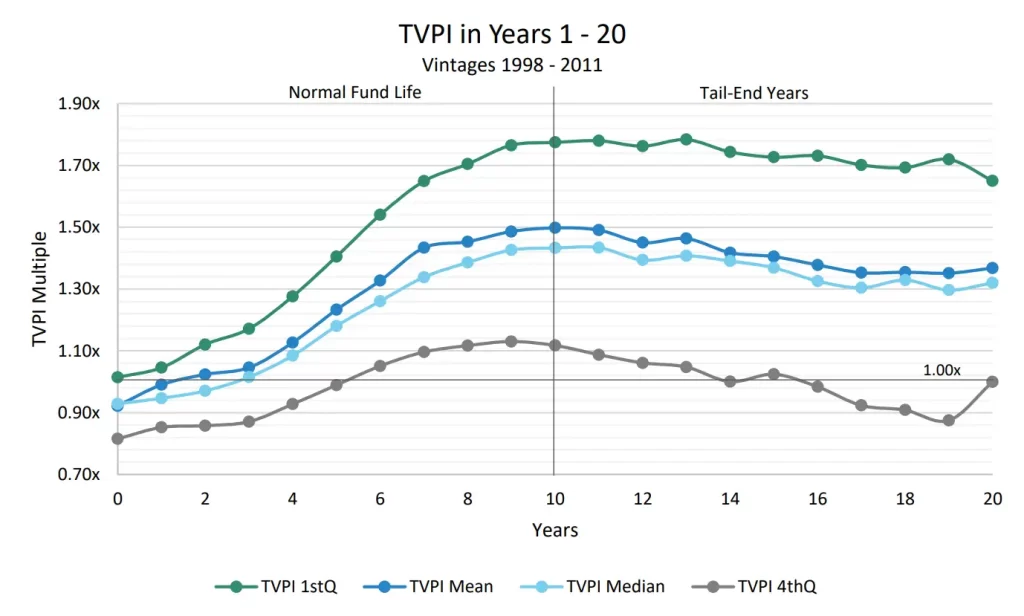

As a follow up to our previous research, this white paper updates our analysis of tail-end private equity portfolios with a focus on US Buyout funds. Utilizing performance data of 1,199 funds over a 20-year period, our work re-enforces many of our past observations but also sheds light on new findings that should motivate LP portfolio managers to take a more active role in how they manage their private equity portfolios, especially underperforming and tail-end funds.